However, it is inclusive of bonuses, overtime, etc. Gross Salary is the amount before deductions of taxes and others.

Below is the break of his cost to the company: Let’s understand the difference between cost to company and take-home salary with the following illustration. In other words, Gross Salary is the amount paid before the deduction of taxes or deductions and is inclusive of bonuses, overtime pay, holiday pay, etc. The amount received post subtracting gratuity and the employee provident fund (EPF) from Cost to Company (CTC) is called Gross Salary. It is variable and depends on several factors which in turn affect the net salary.

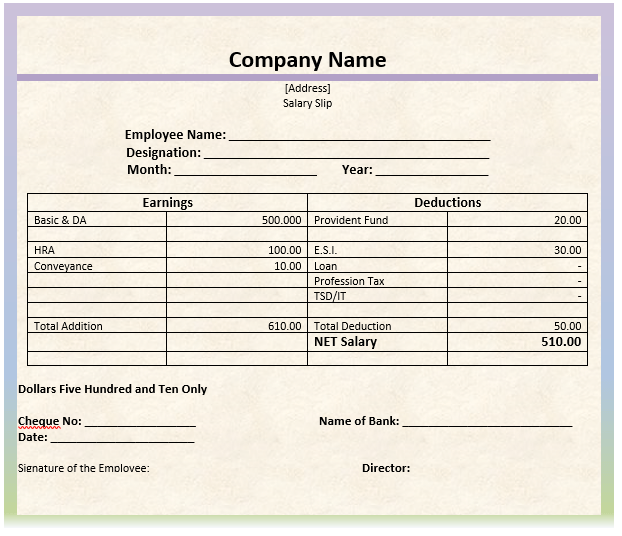

CTC consists of salary, pension, PF contributions, allowances, etc. It is the amount spent on hiring and reimbursing for the employee’s services. Here are the major differences between the two: Cost to Company (CTC)ĬTC can be defined as the total amount an organization spends on an employee during a given year. They can instead invest the same in high yielding investments. Employees do have an option to opt-out of some of these forced savings. Better Understanding:Ī salary slip has components which are forced savings like EPF and ESI. Having knowledge of salary slips and their components can help an employee take advantage of the tax deductions available, hence allowing them to plan their taxes efficiently. It also acts as a negotiating agent for salary hikes while changing new jobs. Choosing the Next Job Smartly:Ī salary slip assists in choosing jobs smartly from different companies while switching jobs. It is very important to understand salary slips and their components as it can help employees take advantage of the situations around them: 1. It also helps in filing income tax returns and applying for loans and mortgages and negotiating for a salary hike when applying for a new job. Also, the salary slip acts as proof of employment. A Salary Slip or Payslip is legal proof of income for an employee.

0 kommentar(er)

0 kommentar(er)